It

is therefore critical that the full value of provisions is recognized at the end of each period, and not just the movement in the

reporting period. Detailed examples on recognition of provisions

are included in Corporate Guidance on Provisions,

Contingent Liabilities and Contingent Assets. For the purpose of this diagram, it is

assumed that the process is centrally coordinated, but this approach may vary

in practice. Offices/Missions fill out an excel spreadsheet and submit to

Accounts Division as part of their year-end financial statements packages.

Under US GAAP, the low end of the range would be accrued, and the range disclosed. An example of determining a warranty liability based on a percentage of sales follows. The sales price per soccer goal is $1,200, and Sierra Sports believes 10% of sales will result in honored warranties. The company would record this warranty liability of $120 ($1,200 × 10%) to Warranty Liability and Warranty Expense accounts.

Some examples of provisions

(b) a possible obligation whose existence will be

confirmed only by the occurrence or non-occurrence of one or more

uncertain future events not wholly within the control of the UN. Suppose a lawsuit is filed against a company, and the plaintiff claims damages up to $250,000. It’s impossible to know whether the company should report a contingent liability of $250,000 based solely on this information. Here, the company should rely on precedent and legal counsel to ascertain the likelihood of damages. Banks use contingent liabilities, which are the government’s contractual obligations to provide for any eventuality of default by the borrower, either on the principal amount borrowed or interest payment on such amount, or both.

- Each business transaction is recorded using the double-entry accounting method, with a credit entry to one account and a debit entry to another.

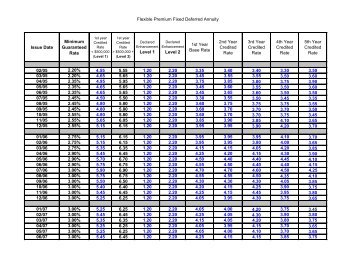

- The discount rate will be

based on the opportunity cost which is the rate of return that could have been

earned from investments held in Cash Pools. - Contingent liabilities must pass two thresholds before they can be reported in financial statements.

- General business risks include the risk of war, storms, and the like that are presumed to be an unfortunate part of life for which no specific accounting can be made in advance.

Warranties arise from products or services sold to customers that cover certain defects (see Figure 12.8). It is unclear if a customer will need to use a warranty, and when, but this is a possibility for each product or service sold that includes a warranty. The same idea applies to insurance claims (car, life, and fire, for example), and bankruptcy. If the contingencies do occur, it may still be uncertain when they will come to fruition, or the financial implications. Pending litigation involves legal claims against the business that may be resolved at a future point in time. The outcome of the lawsuit has yet to be determined but could have negative future impact on the business.

Ledger recordings

A subjective assessment of the probability of an unfavorable outcome is required to properly account for most contingences. Rules specify that contingent liabilities should be recorded in the accounts when it is probable that the future event will occur and the amount contingent liabilities journal entry of the liability can be reasonably estimated. This means that a loss would be recorded (debit) and a liability established (credit) in advance of the settlement. Contingent liabilities must pass two thresholds before they can be reported in financial statements.

Any case with an ambiguous chance of success should be noted in the financial statements but do not need to be listed on the balance sheet as a liability. Other potential examples include guarantees, indemnification obligations, and environmental liabilities. A future obligation or debt of a company that is dependent upon something happening in the future is called a contingent loss.

Recognition of a provision

A contingency occurs when a current situation has an outcome that is unknown or uncertain and will not be resolved until a future point in time. A contingent liability can produce a future debt or negative obligation for the company. Some examples of contingent liabilities include pending litigation (legal action), warranties, customer insurance claims, and bankruptcy. In order for a provision to be recognized, the

outflow of resources should be probable. Whilst IPSAS does not specify a

precise numerical threshold, this is generally accepted as having a probability

of greater than 50% of occurring.

A contingent liability is recorded in the accounting records if the contingency is probable and the related amount can be estimated with a reasonable level of accuracy. Other examples include guarantees on debts, liquidated damages, outstanding lawsuits, and government probes. Two classic examples of contingent liabilities include a company warranty and a lawsuit against the company.

Where Are Contingent Liabilities Shown on the Financial Statement?

If the value can be estimated, the liability must have more than a 50% chance of being realized. Qualifying contingent liabilities are recorded as an expense on the income statement and a liability on the balance sheet. A contingent liability threatens to reduce the company’s assets and net profitability and, thus, comes with the potential to negatively impact the financial performance and health of a company. Therefore, such circumstances or situations must be disclosed in a company’s financial statements, per the full disclosure principle. The objective of this chapter is to give an

overview of the accounting lifecycle of provisions recognition as well as

contingent liabilities and contingent assets note disclosure requirements.

- Since the company’s inventory of supply parts (an asset) went down by $2,800, the reduction is reflected with a credit entry to repair parts inventory.

- In this case, a note disclosure is required in financial statements, but a journal entry and financial recognition should not occur until a reasonable estimate is possible.

- A “medium probability” contingency is one that satisfies either, but not both, of the parameters of a high probability contingency.

- Finally, how a loss contingency is measured varies between the two options as well.

- According to the full disclosure principle, all significant, relevant facts related to the financial performance and fundamentals of a company should be disclosed in the financial statements.

As the contingent liability is for

disclosure purposes only, no entries are required. The most common of these contingent assets

are those considered in Chapter on Revenue from Non-Exchange Transactions. Discounting and the unwinding of discounts

are accounting concepts that do not impact the actual cash payments to be made

in the settlement of provisions, but instead reflect the time value of money. A provision is reversed, either partially

or in full, when it is no longer required. This differs from adjustments to

provisions described in section 3.1.4 below, as reversals involve derecognition

of all or part of a provision (i.e. they no longer meet the provisions

recognition criteria).

Contingent liabilities differ from other liabilities in that they are not recognized on a company’s balance sheet unless the underlying event occurs. Other liabilities, such as accounts payable and loans, are recognized on the balance sheet as soon as they are incurred, regardless of whether the underlying event has occurred. This means contingent liabilities are not included in a company’s current or total liabilities, and they do not directly impact the company’s financial statements unless and until the underlying event occurs. This journal entry is to show that when there is a probability of future cost which can be reasonably estimated, the company needs to recognize and record it as an expense immediately. Likewise, the contingent liability is a payable account, in which the company will expect the outflow of resources containing economic benefits (e.g. cash out). If the contingent liability is probable and inestimable, it is likely to occur but cannot be reasonably estimated.

UK Government Investments Annual Report and Accounts 2022-23 – GOV.UK

UK Government Investments Annual Report and Accounts 2022-23.

Posted: Wed, 19 Jul 2023 07:00:00 GMT [source]

Where a material adjusting event is identified, the

amounts in the financial statements for the reporting period should be

adjusted to reflect the adjusting event. Adjusting events are therefore recognized

in the financial statements in line with the IPSAS guidance applicable to

the issue. The reason is that the event (“the injury itself”) giving rise to the loss arose in Year 1. Conversely, if the injury occurred in Year 2, Year 1’s financial statements would not be adjusted no matter how bad the financial effect.

When both of these criteria are met, the expected impact of the loss contingency is recorded. They believe that a loss is probable and that $800,000 is a reasonable estimation of the amount that will eventually have to be paid as a result of the damage done to the environment. Although this amount is only an estimate and the case has not been finalized, this contingency must be recognized. In order for a contingent liability to be recorded as a journal entry it must be probable and reasonably estimable. The accrual involves debiting and increasing a loss account and crediting and increasing a liability account. Let’s expand our discussion and add a brief example of the calculation and application of warranty expenses.

In this example, we will examine the

process by which accounting entries for a legal case are derived and entered

into Umoja. The cases that are analyzed here are originally booked through FBS1

T-code and thus are automatically reversed by Umoja in the next reporting

period. Approvals

for raising a provision within Umoja are the same as those for raising manual

JVs. Provisions are usually recognized at the end of

each reporting period and will be raised through reversing journal vouchers. This means that the journals will be automatically reversed at the start of the

next reporting period.

Managing and accounting for contingent liabilities can be complex and requires careful analysis and judgement. Companies should consult with legal and financial advisors to ensure that they are properly identifying and managing these liabilities. If the initial estimation was viewed as fraudulent—an attempt to deceive decision makers—the $800,000 figure reported in Year One is physically restated.

Reporting Requirements of Contingent Liabilities and GAAP … – Investopedia

Reporting Requirements of Contingent Liabilities and GAAP ….

Posted: Sat, 25 Mar 2017 17:36:10 GMT [source]

General business risks include the risk of war, storms, and the like that are presumed to be an unfortunate part of life for which no specific accounting can be made in advance. Contingent liabilities are shown as liabilities on the balance sheet and as expenses on the income statement. Both GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) require companies to record contingent liabilities, due to their connection with three important accounting principles. Another way to establish the warranty liability could be an estimation of honored warranties as a percentage of sales. In this instance, Sierra could estimate warranty claims at 10% of its soccer goal sales.

In most cases, the UN should be able to

determine a range of possible values and thus form a reliable estimate. The use of accounting estimates to determine the value of the obligation

is permitted and encouraged where precise values are not available. A Contingent Asset is an economic gain that may come into existence in near future as a result of some past action. The existence of such assets is completely uncertain and beyond the control of the entity. Contingent liabilities are liabilities that may occur if a future event happens.

If the lawsuit is remote (a nuisance suit without any merit), there is no need for a journal entry and no need to disclose the lawsuit. Accountants usually consider product warranties to be a contingent liability that is both probable and can be estimated and is therefore recorded with a journal entry. A contingent liability is a potential future debt that depends on the occurrence or non-occurrence of one or more uncertain future events. Contingent liabilities are not recognized in the financial statements because they are not considered actual liabilities. However, companies must disclose contingent liabilities in the notes to the financial statements.